The Second Mid-term Business Plan (FY2016 – FY2018)

| Date | April 28, 2016 |

|---|---|

| Presenter | Satoshi Hirano, President and CEO |

Summary of the Presentation

(Topcon’s Vision)

Topcon embraces the philosophy “Topcon for Human Life”. We will focus on expanding business by resolving societal challenges in the growth markets of “Healthcare”, “Agriculture”, and “Infrastructure”. For Topcon, this means growing our business in the ophthalmological field (healthcare), the IT agriculture field (agriculture), and the fields of IT construction and infrastructure development (infrastructure). Through our work in these massive business domains, Topcon will apply our solutions towards resolving societal challenges, and through these efforts succeed in growing our business.

(The First Mid-term Business Plan review)

Our first Mid-term business plan (FY2013-FY2015) was based on a vision of shifting to growth strategy from structural reforms. Under this vision, we outlined the following three strategies aimed at targeting ROE 20%. As a result of these initiatives, we successfully realized our growth strategy.

Strategy 1 outlined enhance new business. Success under this strategy included pioneering the IT Agriculture market, securing OEM partners in the MC / AG fields, pioneering the telematics market, developing our 3D measurement business, developing the EMR and remote diagnosis market, and developing the screening market.

Strategy 2 involved launching disruptive strategic products. As a result, although we originally planned to launch 74 models, in total we successfully launched 93 models. We also increased the number of disruptive strategic products from 5 models during the previous 3-year period to 7 models.

Strategy 3 involved proactively utilizing global human resources. Results based on this strategy included increasing the Group-wide composition of non-Japanese employees from 60% to 65%, with the ratio of non-Japanese engineers increasing from 55% to 75%, and the composition of non-Japanese overseas consolidated subsidiary CEOs increasing from 50% to 90%. These changes enabled us to implement the strategic placement of personnel on a global scale.

(The Second Mid-term Business Plan)

The Second Mid-term Business Plan (FY2016-FY2018) embraces a vision for the acceleration of our growth strategy and moving on to the next stage. The plan outlines the following three strategies aimed at targeting ROE 20%.

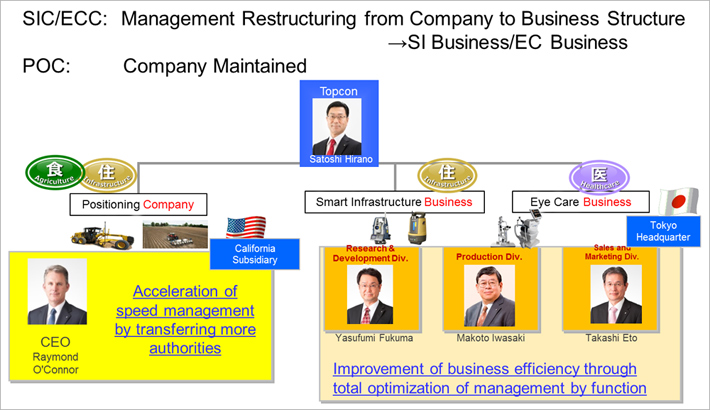

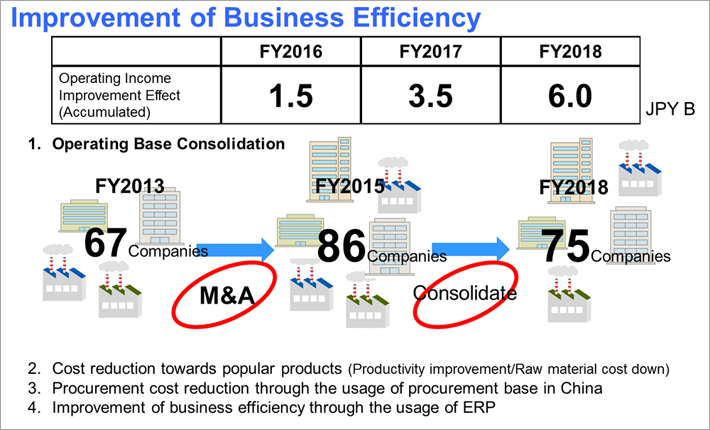

Strategy 1: Strengthening the management structure

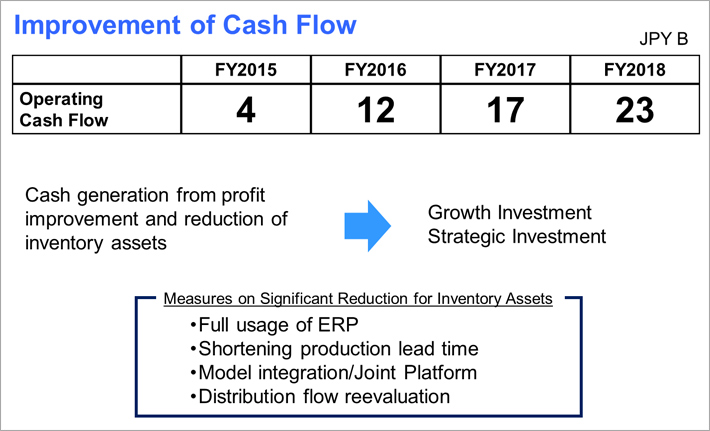

We have restructured our organization into a structure of one company, two business divisions. The Positioning Company(POC) will continue as is while the Smart Infrastructure Company(SIC) and the Eye Care Company(ECC) have been changed to the Smart Infrastructure(SI) Business and Eye Care(EC) Business, respectively. We will eliminate and consolidate offices in an effort to improve operational efficiency. Through M&A, we grew from 67 companies in FY2013 to 86 companies in FY2015 but over the next three years we will contract from 86 companies to 75 companies and eventually narrow down to around 70 companies. Next, we will promote COGS reduction by improving productivity and parts CD. We anticipate that these efforts will improve operating income by 1.5 billion yen in FY2016, a cumulative 3.5 billion yen by FY2017, and a cumulative 6.0 billion yen by FY2018. Improvements to cash flows from operating activities will be allocated towards growth investments.

Strategy 2: Advancement of the growth businesses

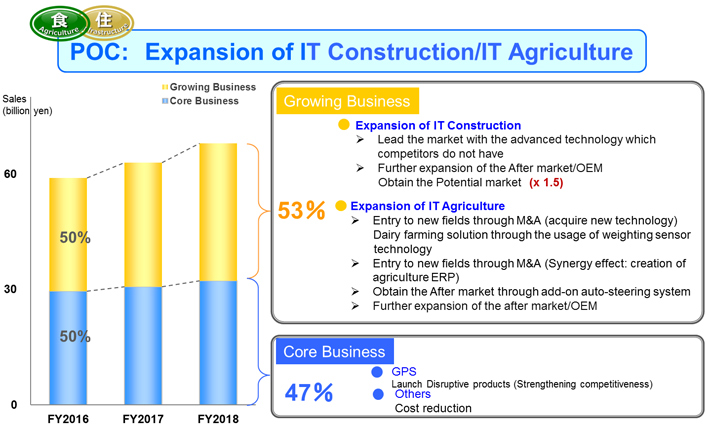

POC will expand IT Construction and IT Agriculture as growth businesses. With IT Construction, we will lead the market by applying our advanced technology not available to our competitors. We will bring about a civil engineering revolution by installing our systems to turn ordinary bulldozers into robots. Combining aftermarket sales and OEM, we are anticipating an installation rate of around 15% for GPS automation systems on bulldozers. We are predicting 5-6% for hydraulic excavators. Overall, we believe the latent market for this technology to be extremely large. As such, we intend to develop this business into a major pillar for our growth strategy. Over the 3-year period, we will aim for sales growth of around 150%.

Next is the IT Agriculture market. We can achieve significant growth by increasing both aftermarket sales and our OEM business. However, last fiscal year saw a lull in the agriculture industry so we are not anticipating much growth for this fiscal year. Overall, we expect sales to be largely unchanged. The belief is that the agriculture industry will see notable growth on global markets in FY2017 or FY2018 so we believe that continuing our current efforts will lead to significant growth in the future.

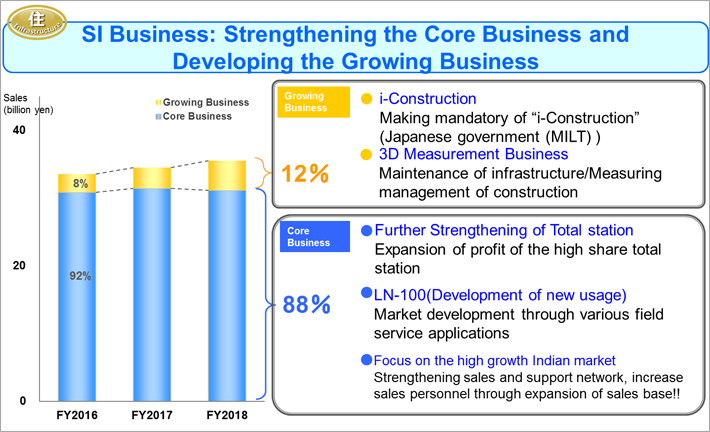

The core business of the SI Business is incredibly largest and the business is not one that is expected to see major growth. We will focus on strengthening the core business, which is the main driver of income. At the same time, we want to emphasize developing growth businesses. Next is i-Construction. The MLIT is focusing on this domain as a core theme and it has been stated that by 2020 they will being requiring 100% integration of i-Construction for all publicworks overseen by the government in order to improve the productivity of Japan’s civil engineering projects. Next is our 3D measurement business. The deterioration of social infrastructure is resulting in the need for structural surveys in order to conduct maintenance. Next is our core business. As an extremely vital core business, we are producing between 20,000 and 30,000 Total Station units annually. In the next medium-term business plan, we will consolidate the number of models from 300 to 30 in order to improve profitability.

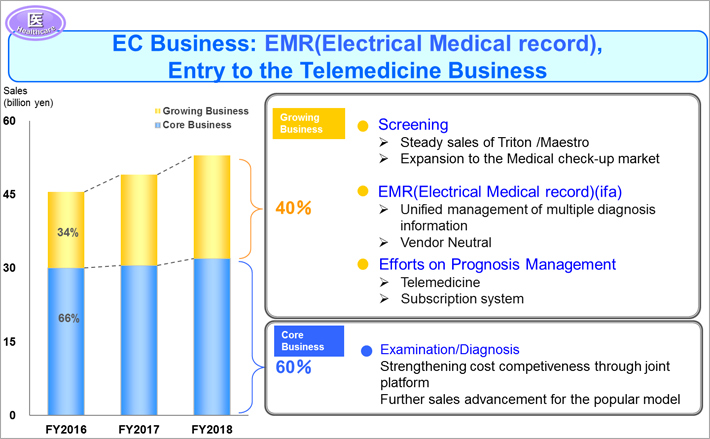

For the EC Business, we will expand EMR for ophthalmology and remote diagnosis as new business domains. Previously, our only existing businesses were examinations and diagnostics but with the acquisition of ifa we will expand our business domains into the fields of preventative medicine and prognosis in order to expand market size from 250.0 billion yen to 500.0 billion yen. For the screening business in the preventative medicine domain, we will expand sales of the Maestro, a simple system that can be used by anyone. The EMR developed by ifa are vendor neutral, enabling them to be connected with devices from all manufacturers, represented over 500 devices. For physicians and hospitals, EMR can be linked not only to Topcon devices, but to all devices in their facilities. Using ifa’s systems will also enable remote diagnosis. Through remote diagnosis, patients can receive EMR and remote diagnosis simply by going to major retail chain stores, optical shops abroad, or their local doctors or reading centers, with no need to visit a major hospital. Through these businesses, we will promote early detection, preventative medicine, and prognostic care throughout the world and further pioneer these markets. Thus far, our business model has been based on sales only but incorporating ifa EMR and remote diagnosis has enabled us to incorporate a fee-based system.

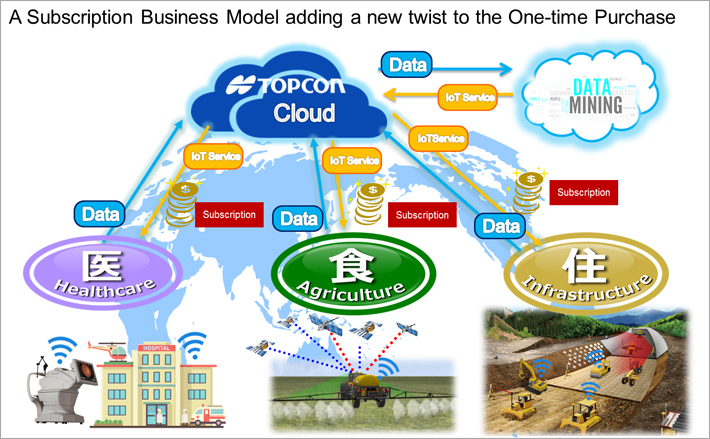

Strategy 3: Creation of a Subsctiption business model

Our current business model is based on sales only but we will incorporate a subscription business into our “one-time purchase business” model. Thus far, all Topcon business models, including OCT, agriculture, and construction, have been based on analog data management but we will transition to digital management, which will enable us to collect data. We have a cloud system that we use for agriculture and at construction sites and we hope to accelerate the use of this system. For the subscription business model for the EC business, the ifa system will collect data from all devices installed in individual hospitals in addition to data from Topcon devices. This will enable us create subscription services based on the data gathered from variety of devices using data mining that support diagnosis, prescriptions, etc. Our strength is our ability to be vendor neutral.

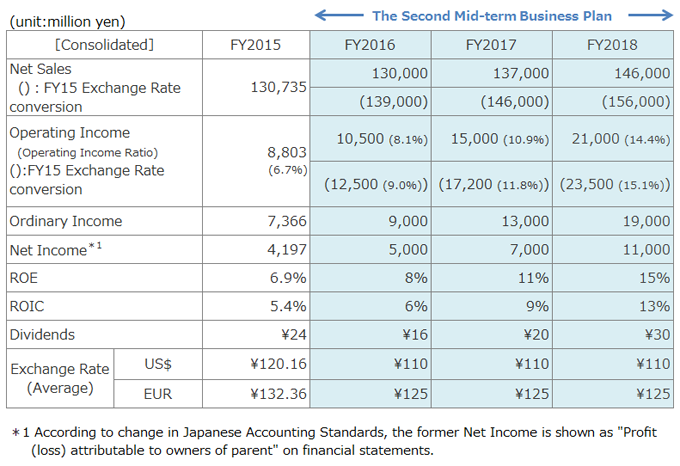

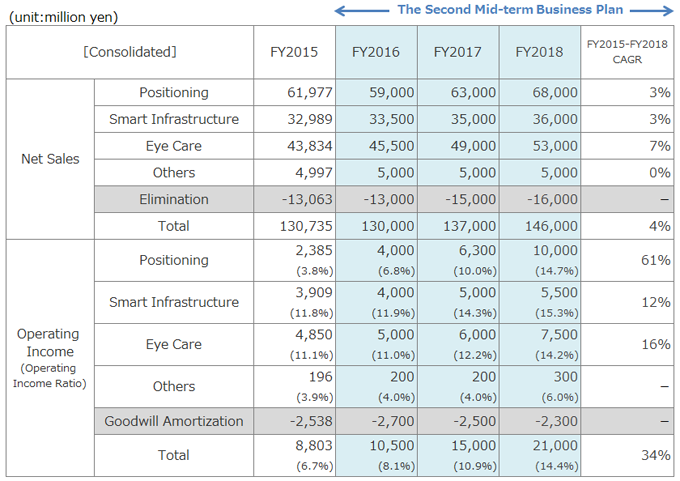

Our financial targets are as follows. During the period of our medium-term business plan, we are assuming currency rates of 110 yen/USD and 125 yen/Euro. We are expecting net sales of more than 130.0 billion yen, largely unchanged from FY2015 and 146.0 billion yen in FY2018. For operating income, with improvements to operating efficiency we are anticipating 10.5 billion yen, 15.0 billion yen, and 21.0 billion yen respectively for each fiscal year, representing CAGR-based growth of 32%. ROE fell to 6.9% but we are expecting 8%, 11%, and 15%. We will achieve 15% and then worth to achieve 20% as quickly as possible. For annual dividends, for the current fiscal year we are projecting 16 yen, 20 yen for FY2017, and 30 yen for FY2018. By segment, for POC we will aim for 68.0 billion yen within 3 years, 3% based on CAGR. For the SI business, we will aim for 36.0 billion yen, 3% based on CAGR, and 53.0 billion yen for the EC Business, 7% by CAGR. Regarding segment-based operating income, for POC we will implement measures to improve operating efficiency and aim for 10.0 billion yen, 61% based on CAGR. For the SI Business, we will aim for 5.5 billion yen, 12% by CAGR, and 7.5 billion yen, 16% by CAGR, for the EC business. In total, we will achieve 21.0 billion yen, 34% of CAGR. Our investment plans for our growth strategy are as follows. We will apply approximately 10% of sales towards R&D. For capital expenditures, we will invest approximately 4.0 billion yen each. During the first year, we will examine the economic environment but refrain from making aggressive investments. In total, we are assuming approximately 20.0 billion yen.

Financial Target (Consolidated)

Financial Targets (by Segment)

Q&A

※For the FY2015 Financial Results briefing and held at the same time, will also be included in matters related to the FY2015 Financial Results are in question-and-answer session.

-

Last fiscal year you conducted downward revisions on multiple occasions and now you have released an even more significant downward revision. What are the intrinsic causes behind these decisions?

We hoped to cover the drop in IT Agriculture with new product launches for IT Construction by POC. However, a decline in resource prices resulted in a significant drop in demand. For SIC, delays in orders for public works led to a decline in orders. A decline in demand caused us to fall short of sales targets.

-

What caused POC operating income to fall so significantly in 4Q? Is there a major change in the income environment?

The income environment has not changed. Sales were largely impacted by the 8.0 billion yen decline in our existing IT agriculture business. Also, a company we recently acquired was impacted by the IT agriculture business. Although it did not record losses, income did decline due to a drop in sales. -

What is the status of IT Construction aftermarket sales for POC during 4Q?

Considering previous 4Q sales did not grow as much as expected, we do not expect sales to grow during 1Q or 2Q of this fiscal year.

-

In your Mid-term Business Plan you outlined that cash flows from operations will improve significantly but how do you plan to accomplish this? Will your planned investment and loan amount for the next three years be covered by those cash flows?

We plan to fully utilize ERP to significantly reduce increased inventory assets. We plan for those improvements to cover our investment and loan capital.

-

Please provide a general idea of your view on income gains or losses for the current fiscal year.

Increased income of 1.7 billion yen consists of cost reductions of 1.5 billion yen with the remainder being the result of new product launches and sales of the Maestro on the US market.

-

When will you initiate your sales plans for the Maestro on the US market after obtaining FDA approval?

We are aiming for the second half. There was a need to resubmit our application so we are taking a conservative approach.

-

Why are you forecasting that POC income will improve significantly in the second half?

This is because the majority of cost reductions are related to POC and those benefits will be seen in the second half.

-

Q. To what extent is the subscription model included in plans?

This model is largely not reflected in the Second Mid-term Business Plan. In the Second Mid-term Business Plan, it will be positioned as a business requiring development.

-

Is your 3-year plan a fixed schedule and does that mean you will not reevaluate the plan?

We intend on this being a fixed schedule. While our figures may change because we are in an environment susceptible to significantly market changes, we will not change our strategy or policies.

Cautionary Note regarding Forward-Looking Statements

These materials contain forward-looking statements, including assumptions and projections based on the information available at the time these statements are made. However, please be aware that actual performance may differ from projected figures owing to unexpected changes in the economic environment in which we operate, as well as to market fluctuations.