Mid-Term Business Plan 2016 ( FY2014 to FY2016)

| Date | April 25, 2014 |

|---|---|

| Presenter | Satoshi Hirano, President and CEO |

Summary of the presentation

Mid-Term Business Plan 2016

In the Mid-term Business Plan 2016, we are aiming to become a true global top by achieving profitable and sustainable growth via creativity. In addition, in accordance with our new slogan “Creativity & Growth,” our focus is now on growth markets as business domains and the expansion of these growing fields.

In the Mid-term Business Plan 2016, we are executing three key strategies to achieve our target of an ROE of 20%.

Strategy 1 is the enhance of new businesses and strengthen core businesses. In the final year in our mid-term business plan (FY2016), we aim to boost the sales ratio of new businesses to 51% of total sales in the company overall, 60% of sales in the Positioning Company, 50% of sales in the Smart Infrastructure Company, and 38% of sales in the Eye Care Company.

Strategy 2 is the launch of disruptive, strategic products. During the three-year period covered by the Mid-term Business Plan 2016, we plan to release 65 new product models companywide (we released 30 new product models in FY2013). We plan to increase the introduction of strategic products to 45 models.

Strategy 3 is the utilize of global human resources. At present, 60% of the Topcon Group’s total workforce consists of non-Japanese employees. In addition, presidents at 45 of our 53 overseas consolidated subsidiaries, 85%, are non-Japanese. We are aiming to place the right people in optimal positions globally.

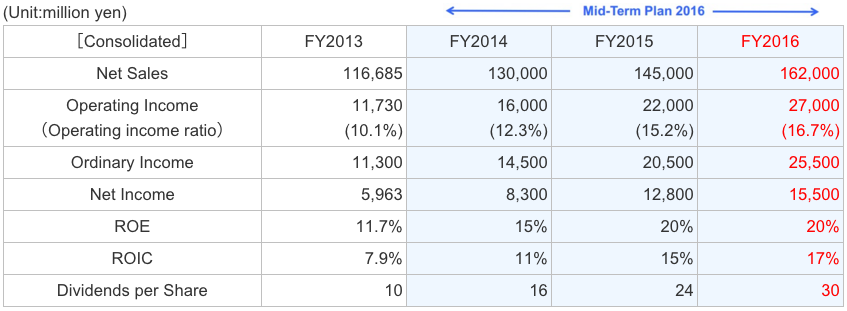

Financial Target (Consolidated)

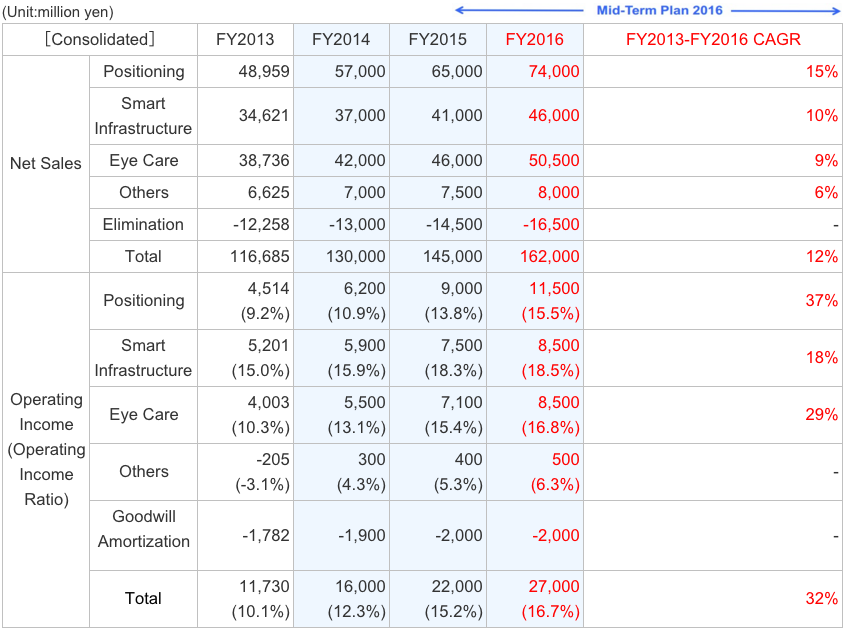

Financial Target (by In-house Company)

(Strategic Plans by Companies)

In the Positioning Company, our basic policy is accelerating IT Construction and IT Agriculture with strong GNSS core technology. In the IT construction business (market size of ¥110 billion), we plan to promote the shift from 3D using Sitelink3D to 4D management, and also expanding the OEM business. In the IT precision agriculture business (market size of ¥200 billion), we aim to promote the fortification of automated fertilizing, customer earnings forecasts, and promote the OEM business. We anticipate growth in the OEM business going forward, as OEM manufacturers of construction and agricultural machinery are on the threshold of entering a period of full-fledged, rapid growth.

Our basic policy in the Smart Infrastructure Company is to enhance new business with strong basis of surveying instruments. One new business is the Building Information Modeling business (market size of ¥40 billion). We are spearheading growth in the BIM market, owing to the launch of a new product in January 2014. In the Smart Sensing of aging infrastructure business (market size of ¥30 billion), we plan to introduce the smart sensing system for aging infrastructure to reduce social cost drastically. In the Construction Information Modeling business (market size of ¥40 billion), we plan to release advanced sensors and cloud solutions. We also aim to enhance our competitive strength by reducing costs by adopting automated manufacturing system.

In the Eye Care Company, our basic policy is to strengthen prognostic management and treatment segment by enforcing competitiveness of examination/diagnosis segment. Through the development of our OCT business, which includes screening, treatment and prognostic management, we aim to grow sales. In the new OCT business domain (market size of ¥30 billion), we plan to introduce new products that utilize OCT, which makes various illnesses visible in the retinal structure. In Prognostic Management System (market size of ¥30 billion), we plan to establish a business using cloud technologies for OCT with fully automatic operation. We plan to expand our screening business (market size of ¥82 billion) with OCT with fully automatic operation. In the treatment device business (market scale of ¥70 billion), we also aim to release synergistic products that integrate pattern laser technologies with OCT with fully automatic operation. We also aim to improve our profit margins. Moreover, we plan to strengthen our T-GREAT group of experts by making it a six member team, to improve our dealings with the US FDA.

Q&A

-

There are no changes to your medium-term targets in the Mid-term Business Plan 2015. Has your confidence in achieving the goals in this plan changed? And is there a specific reason why you did not change your targets?

We gained a great deal of confidence when we achieved our forecasts for FY2013. Our earnings are underpinned by a brisk market and the benefits we have reaped from the unique products and technologies at our three companies. We believe that we can accelerate our performance going forward.

-

We understand the ratio of OEM in the agriculture business is high but how do you plan to expand your own business while increasing the OEM business?

We set conservative goals for the OEM business in consideration of our partners. We conduct the aftermarket business independently and I believe the figures reflected in our mid-term business plan are accurate. The figures for the OEM business are likely to be slightly higher than those in our plan.

-

Does the shift to 4D management in the IT Construction business reflect a change in business model to establish a solutions business? Doesn’t this mean you will be competing with construction machinery manufacturers?

In addition to the hardware and firmware businesses, we are adding the site management business so there will be a slight change in our business model. We have already released Sitelink3D on the market. Once customers being to use this system, it will develop into business for us.

-

When do you plan to launch OEM for hydraulic excavators?

This depends on our OEM partner’s schedule so it is not something we can disclose. One construction machinery manufacturer plans to release an OEM product as early as this year. We expect the hydraulic excavator market to be several times larger than the bulldozer market.

-

When will you receive FDA approval for the 3D OCT?

We believe we will receive approval in the first half of FY2014.

-

Performance in the Eye Care Company recovered thanks to your last-minute efforts. Does this reflect a positive market environment in Europe? Will this performance continue?

Europe is the largest market for this business. However, market conditions are not favorable. Our results reflect brisk sales of the OCT.

-

In the mid-term business plan for the Positioning Company, you estimated profit margins would deteriorate due to an increase in the ratio of OEM sales. Why did your profit margin improve?

Unlike car navigation systems used by general consumers, the profit margins at our aftermarket and OEM products are nearly the same. There is a volume discount for OEM products but we were able to reduce our COGS at the same time.

-

Will the pace of growth increase compared to the estimate in your mid-term business plan if the expansion of OEM for construction and agriculture machinery picks up?

Traditionally, these products were sold as aftermarket products. We were finally able to launch the OEM business after a very long preparation period. We believe that we will be closer to reaching our targets once we accelerate growth of our OEM business.

Cautionary Note regarding Forward-Looking Statements

These materials contain forward-looking statements, including assumptions and projections based on the information available at the time these statements are made. However, please be aware that actual performance may differ from projected figures owing to unexpected changes in the economic environment in which we operate, as well as to market fluctuations.